US Government Finds Smoking is Good For Your Health

Imagine such a headline. The US led a legal battle for over 40 years and secured a finding that cigarettes caused cancer. This was both a legal and scientific finding: cigarettes caused cancer. The cigarette companies collectively had to pay billions and agree to stringent controls over their cancer-causing product.

The same just happened again. The Trump administration had the EPA (Environmental Protection Agency) withdraw a scientific finding that greenhouse gases threatened human life and wellbeing. This, too, was a scientific fact, proven and legally valid.

Why would the US government invalidate a scientific and legal finding?

“Hoax,” claims the administration, even though the facts were established under President Nixon and upheld by every administration and world body since.

This “deregulatory” move reverses the endangerment finding that allowed the EPA (yes, the agency that protects our health) to enforce limits on emissions of carbon dioxide, methane, and other pollutants. These pollutants were regulated because they showed a direct connection to killing Americans.

“Greenhouse gases.” CO2 is not a pollutant, claimed the Interior Secretary, saying “we emit it in our breath.” Of course this is true, but what does it mean? Nothing in regard to why the EPA regulates emissions.

In addition to killing Americans, these emissions cause climate change. Again, this is a scientific and legal finding. Denying this is like denying gravity. You can say gravity doesn’t exist, but don’t jump off a building to prove it.

The basis and hallmarks of US government and US business were founded in science and legal reasoning.

The world will not follow the US in this ridiculous action. It will set back US competitiveness, increase global temperatures, and kill Americans.

Realgy Energy Services is a registered Retail Energy Marketer serving commercial customers in the states of Illinois, and Indiana. We offer Service Plans that will provide electric and natural gas at wholesale pricing direct to customers without any utility markup. Our Service Plans work with the local utility to provide seamless service and annual energy savings. Service Plans include Guaranteed SavingsTM, ManagedPriceTM, ManagedGreenTM Index, Fixed and PriceAssuranceTM.

Realgy owns and operates 11 solar plants in Illinois and is looking to invest in additional locations. Soon to be 12 with the inclusion of Highland Park newest recreation center West Ridge Center – New Community Recreation Facility Coming in 2026 | Park District of Highland Park

Additional Information:

Trump touts climate savings but new rule set to push up US prices | Environment | The Guardian

February Pricing – Understand the Recent Spike in Electricity Prices

February Pricing – Understand the Recent Spike in Electricity Prices

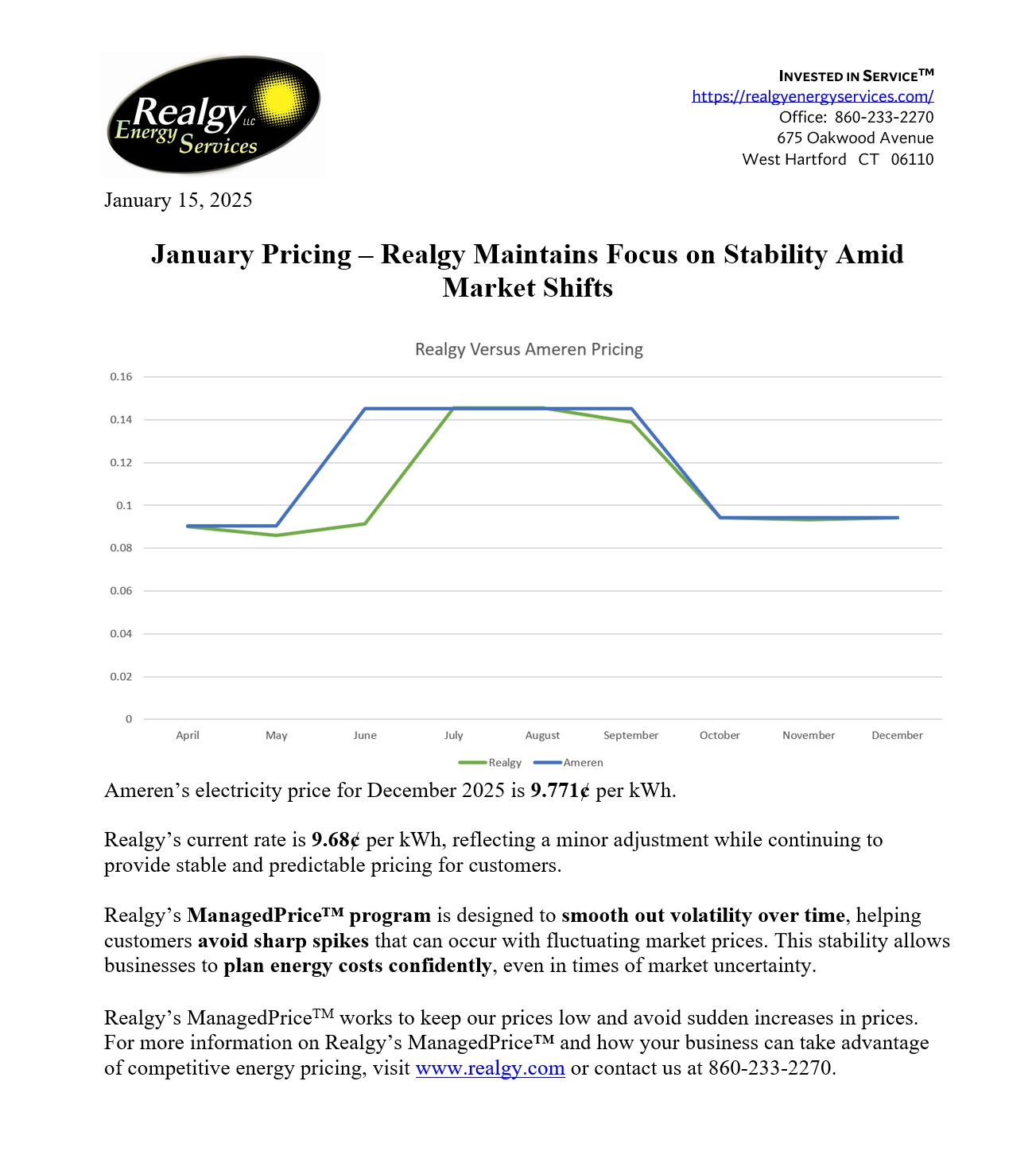

Chart Description: Solid lines reflect current ISO market prices (PJM and MISO), while dotted lines show Realgy’s settlement costs, which lag due to settlement timing.

Realgy purchases power in the month it is incurred, while utilities reconcile wholesale costs later and pass them through over time to minimize rate shock.

Weather plays a significant role in electricity pricing. In early February, the wholesale electricity market experienced a sharp but short-lived price spike. While extreme weather was a major driver, several additional factors contributed to the increase.

What Caused the Spike?

Extreme Winter Weather

Cold temperatures across the Midwest and Mid-Atlantic significantly increased electricity demand as homes and businesses relied more heavily on heating systems.

Reduced Reserve Power

Independent System Operators (ISOs) maintain reserve generation to support unexpected increases in demand. During this period, reserve power was lower than normal, limiting the system’s ability to respond to higher load.

Aging Generation Infrastructure

Older Coal Plants that were originally scheduled to retire have now been declared national security and required to remain open. These coal plants break down frequently and are costly to fix, leading to tightened supply during peak demand periods.

Seasonal Maintenance Outages

Winter is a common time for generator maintenance. With fewer generators available and higher demand, price spikes will ensue.

What’s Next?

Wholesale pricing has already started to stabilize and trend downward. Current projections indicate march pricing should return closer to January levels.

Utilities such as ComEd, Ameren, And MEC purchase power from the wholesale market and pass these costs through customers with a delay.

At Realgy Energy, we closely monitor the wholesale market and adjust pricing proactively to reflect changing conditions. Temporary price adjustments made for mid-February were a direct response to these market dynamics and were designed to protect long-term stability for our customers.

We remain committed to transparency and will continue to track market trends closely to provide competitive and reliable energy solutions.

Realgy Energy Services is a registered Retail Energy Marketer serving commercial customers in the states of Illinois, and Indiana. We offer Service Plans that will provide electric and natural gas at wholesale pricing direct to customers without any utility markup. Our Service Plans work with the local utility to provide seamless service and annual energy savings. Service Plans include Guaranteed SavingsTM, ManagedPriceTM, ManagedGreenTM Index, Fixed and PriceAssuranceTM.

Realgy owns and operates 11 solar plants in Illinois and is looking to invest in additional locations. Soon to be 12 with the inclusion of Highland Park newest recreation center West Ridge Center – New Community Recreation Facility Coming in 2026 | Park District of Highland Park

Additional Information:

Chicago Area Moves Ahead on EV Chargers

Consider this opportunity.

Most of the energy on Earth comes from the sun, nearly 99%. Electricity generation has historically been dominated by fossil fuel combustion, but electricity demand is soaring. The ability to generate electricity using solar and wind has never been more economical, now costing less than fossil fuels.

If you had to plan for the next 100 years, would you choose to provide new electrical generation using the least-cost option, while also gaining environmental benefits?

This is exactly the opportunity reflected in the ongoing actions and planning taking place across the United States at the county, state, and city levels.

With the new administration, the federal government cut funds that were included in previous laws designed to invest in technology supporting EVs, wind, and solar adoption. Despite this, solar and EV adoption continue to grow rather than decline.

WHY?

Cost is critical, but so are convenience and long-term planning.

Chicago-area mayors foresee EV adoption rising to over 1 million vehicles by 2030. The number one issue in adoption is charging, specifically reducing range anxiety.

These communities, both affluent and less wealthy, are joining together to ensure they are prepared. Their considerations include:

-

Permit issuance for charging equipment in 10 days or less

-

EV and solar expertise in construction review

-

Utility support and incentives for installing EV chargers

-

State of Illinois support to promote and plan initiatives

They recognize the reality that solar provides the most power on our planet, is cost efficient, and can be installed quickly.

The best future will be achieved by those who understand reality and plan for it.

Realgy Energy Services is a registered Retail Energy Marketer serving commercial customers in the states of Illinois, and Indiana. We offer Service Plans that will provide electric and natural gas at wholesale pricing direct to customers without any utility markup. Our Service Plans work with the local utility to provide seamless service and annual energy savings. Service Plans include Guaranteed SavingsTM, ManagedPriceTM, ManagedGreenTM Index, Fixed and PriceAssuranceTM.

Realgy owns and operates 11 solar plants in Illinois and is looking to invest in additional locations. Soon to be 12 with the inclusion of Highland Park newest recreation center West Ridge Center – New Community Recreation Facility Coming in 2026 | Park District of Highland Park

Additional Information:

Chicago-area mayors push ahead on EVs despite federal… | Canary Media

Leadership with technology can bring dramatic change

A large US utility is changing to meet market demand!

Consider this statement issued by one of the largest utilities in the US:

“The 2010s version is, you’ve got big players, a single project for the entire need. It’s an old-school utility procurement,” said Josh Tom, National Grid’s director of energy transition solutions. “It’s a closed system, not accessible to everyone. And it can take a long time.”

These slow, burdensome, and costly approaches have yielded only a handful of successful projects over the years. National Grid’s new program, by contrast, is built around a marketplace platform into which companies can bid resources ranging from big batteries to lots of smart thermostats.

They just BLEW UP their business model. Utilities in the US already have competition for power and gas supply. Their last exclusive service (monopoly) was in the distribution of electricity and gas.

This utility, National Grid, recognizes that it cannot solve the distribution problem without adding to its other problem, which is cost.

So, what is the alternative? Yankee ingenuity, good old competition, or market response. National Grid is seeking to allow the utility to dispatch or control battery chargers, home generators, EVs, solar panels, and any generation or larger demand loads (big appliances). They will not own or pay for these sources, therefore they will have little cost. However, by increasing power supply for short periods of time or decreasing demand, they are looking to relieve peak congestion and pricing.

Realgy congratulates National Grid on its focus on addressing and helping to solve all related problems.

Realgy Energy Services is a registered Retail Energy Marketer serving commercial customers in the states of Illinois, and Indiana. We offer Service Plans that will provide electric and natural gas at wholesale pricing direct to customers without any utility markup. Our Service Plans work with the local utility to provide seamless service and annual energy savings. Service Plans include Guaranteed SavingsTM, ManagedPriceTM, ManagedGreenTM Index, Fixed and PriceAssuranceTM.

Realgy owns and operates 11 solar plants in Illinois and is looking to invest in additional locations. Soon to be 12 with the inclusion of Highland Park newest recreation center West Ridge Center – New Community Recreation Facility Coming in 2026 | Park District of Highland Park

Additional Information:

Massachusetts tries a market for distributed energy to… | Canary Media

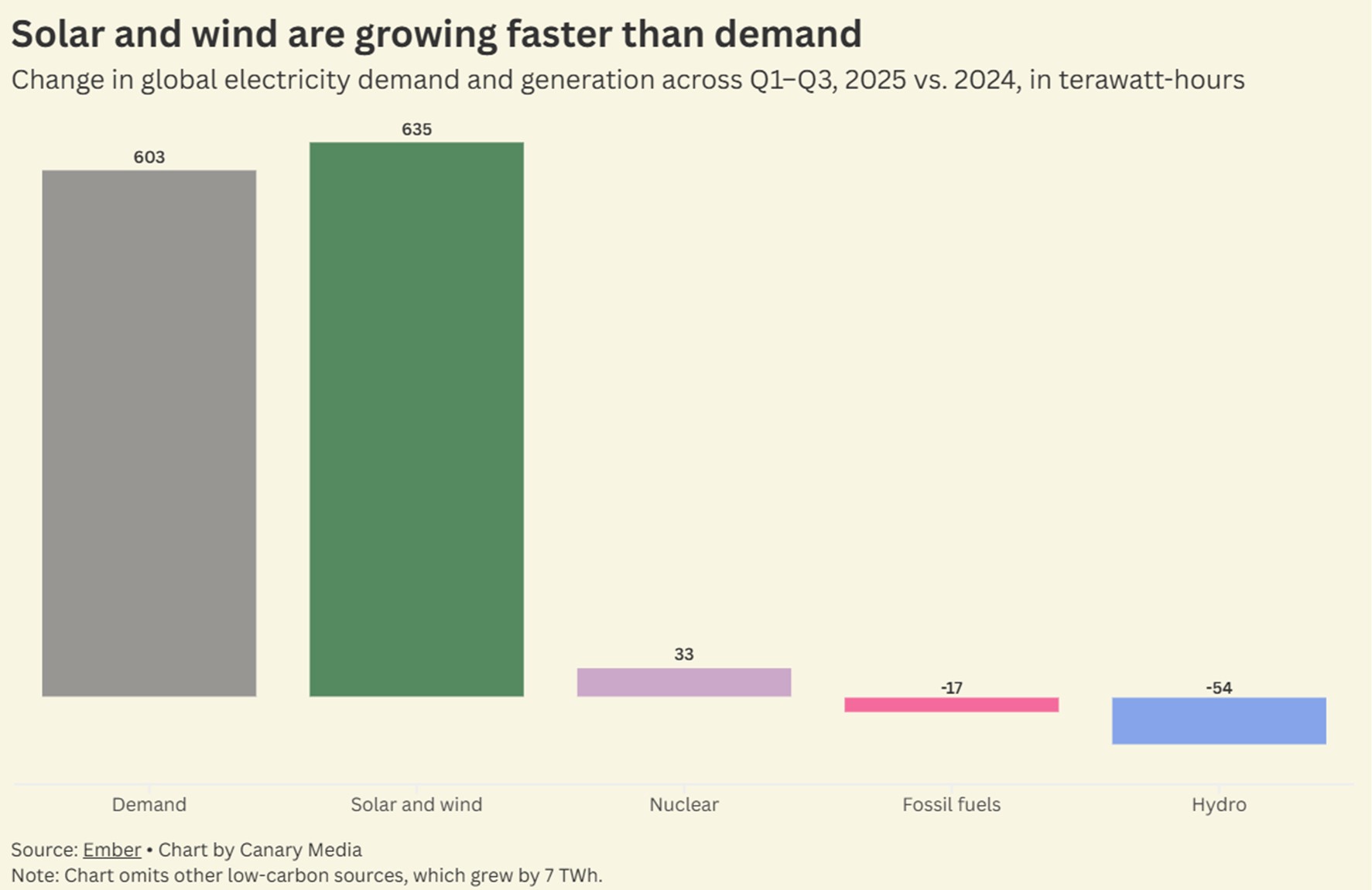

Solar and wind are meeting — and exceeding — new power demand

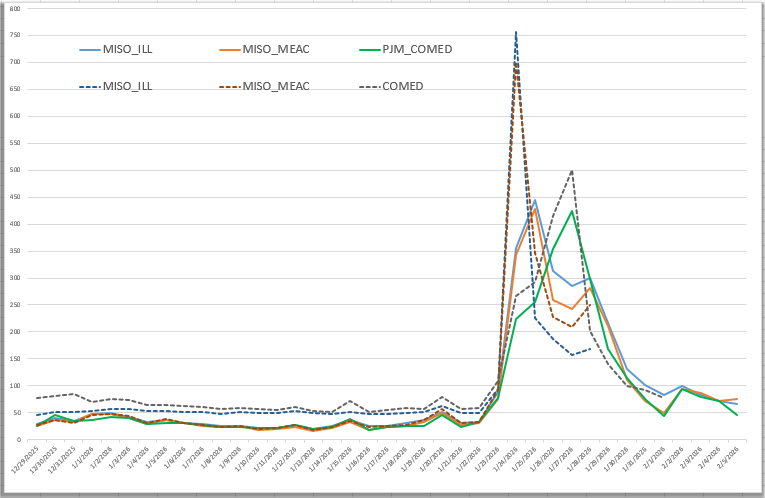

Global electric demand grew last year. Probably not a surprise given the energy demands coming from AI (artificial intelligence) and data centers.

However, unless you are in the energy business or closely follow economic news, you might be surprised to learn what is supplying that growing electric power demand.

If you were listening to business news or momentum investing, startups in nuclear energy went up 200–300 percent. Fossil fuel generation declined across all geographies. In the US, utilities in high-demand regions (where data centers are being built) went up due to their monopoly on delivering power, while independent power generators went up twice as fast

As the chart above shows, power demand grew and was primarily met with wind and solar. This is not news in the energy industry.

Shows like Land Man (Netflix) promote the fossil fuel industry’s gripes against wind and solar, but the reality is they are the least-cost option for supplying electricity in almost all markets.

Realgy Energy Services is a registered Retail Energy Marketer serving commercial customers in the states of Illinois, and Indiana. We offer Service Plans that will provide electric and natural gas at wholesale pricing direct to customers without any utility markup. Our Service Plans work with the local utility to provide seamless service and annual energy savings. Service Plans include Guaranteed SavingsTM, ManagedPriceTM, ManagedGreenTM Index, Fixed and PriceAssuranceTM.

Realgy owns and operates 11 solar plants in Illinois and is looking to invest in additional locations. Soon to be 12 with the inclusion of Highland Park newest recreation center West Ridge Center – New Community Recreation Facility Coming in 2026 | Park District of Highland Park

Additional Information:

Chart: Solar and wind are meeting — and exceeding —… | Canary Media

January Pricing – New Year, Same Reliable Rates

Invested in ServiceTM

https://realgyenergyservices.com/

Office: 860-233-2270

675 Oakwood Avenue

West Hartford CT 06110

January 14, 2026

January Pricing – New Year, Same Reliable Rates

Realgy’s electricity rate for January 2025 is 5.68¢ per kWh, down from 12.35¢ in August, giving businesses more control over their energy costs. With this rate drop, companies can avoid sudden market spikes, better plan their budgets, and focus on running their business with confidence.

Realgy’s ManagedPriceTM works to keep our prices low and avoid sudden increases in prices.

For more information on Realgy’s ManagedPrice™ and how your business can take advantage of competitive energy pricing, visit www.realgy.com or contact us at 860-233-2270.

Illinois Solar Brings Jobs and Job Training

Implementation of the State of Illinois’ investment in solar has not been without issues.

Illinois has supported solar investment in conjunction with job programs and small business incentives.

Unfortunately, blending these priorities has not been without issues; consider the restitution program for the payment of RECs to the Illinois Shine administrator (typically a small business) that was not paid to the solar project owner.

HOWEVER, such implementation missteps and having multiple priorities are now returning benefits.

The Illinois Shine program has recertified future REC payments to help ensure the payments flow to the solar project owners.

Illinois solar installers are booming. This is due in part to the State of Illinois requiring job training, prevailing wage payments, and implementation review (oversight).

Realgy’s experience has been such an example.

We are trying to recover funds from the Illinois Shine restitution program. However, we continue to invest in solar projects in Illinois.

Our installer, Love Energy, through its investment in training, support, and mentorship, is now a competitive energy installer.

Sometimes it takes a reboot to achieve all the benefits of a program.

Congratulations to the State of Illinois for continuing to work toward creating a solar program that supports not only lower energy prices but good jobs and a better environment.

Realgy Energy Services is a registered Retail Energy Marketer serving commercial customers in the states of Illinois, and Indiana. We offer Service Plans that will provide electric and natural gas at wholesale pricing direct to customers without any utility markup. Our Service Plans work with the local utility to provide seamless service and annual energy savings. Service Plans include Guaranteed SavingsTM, ManagedPriceTM, ManagedGreenTM Index, Fixed and PriceAssuranceTM.

Realgy owns and operates 11 solar plants in Illinois and is looking to invest in additional locations. Soon to be 12 with the inclusion of Highland Park newest recreation center West Ridge Center – New Community Recreation Facility Coming in 2026 | Park District of Highland Park

Additional Information:

Illinois’ booming solar sector entices young job… | Canary Media